Good morning all and a happy Sunday to everyone.

Entering 2025 the key questions for the markets were whether there were events on the horizon that could destabilize the current market narrative around U.S. exceptionalism. U.S. equities have become the “must-own” asset for almost any investors across the globe. Not only did owning this lead to strong equity returns, but the outperformance of the U.S. Dollar meant that foreign owners were compounding at higher rates of return. The underlying market narrative that had driven U.S. equities to represent 74% of the MSCI World Index (market cap weighted index for developed economies) was that of technology leadership.

What was going to disrupt this dominance? Trump policy mistakes? Uncontrolled inflation? Competition for the U.S. Dollar as the global reserve currency?

Out of China came a heat seeking missile which hit straight at the heart of the market narrative, finding the point of market exuberance and causing Nvidia to lose $600 billion dollars in market capitalization in a single day (beating its own single day record of $279 billion from 2024).

STEM

The event that unleashed the market sell-off was the release of a 3rd AI model (DeepSeek V3) out of a Chinese quantitative hedge fund, apparently trained with a budget of less than $6 million. The U.S. government had placed constraints on the export of the highest end semiconductor chips to China and therefore Chinese programmers adapted to working with prior generation chips from Nvidia. The market narrative was disrupted because U.S. based tech companies continued to spend hundreds of billions on the latest technology, driving concerns around the effectiveness of their capital expenditures.

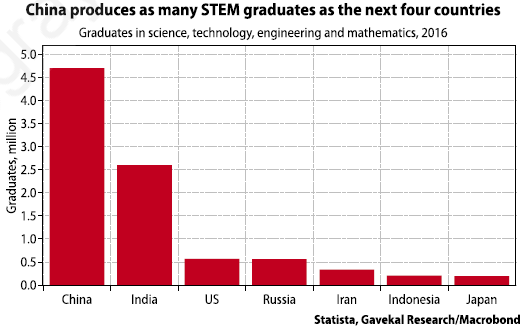

It seemed inevitable that other nations would catch-up and possibly overtake the U.S. on the technology front. As this excellent chart from GaveKal, with data from 2016, shows China has been producing more STEM (science, technology, engineering and math) graduates than the next 4 countries combined.

Deeply Seeking Answers

One of the great advantages of sitting inside such a dynamic and entrepreneurial ecosystem as Sagard, is our access to industry experts. Parinaz Sobhani joined the Sagard team last year as the Head of AI. I took the opportunity to ask Parinaz some important questions to help guide my view on the disruptive capabilities of DeepSeek:

Is Deep Seek for real? Does it work as effectively as ChatGPT for example?

Large language models (LLMs) have shown impressive abilities in generating coherent text but have long been limited by their “parrot-like” approach—they mostly repeat patterns from their training data without engaging in true reasoning. This means that while they can produce fluent text, they often fall short when it comes to analyzing complex problems, drawing logical inferences, and providing systematic, step-by-step solutions. The next frontier in AI is reasoning models, which are designed to overcome these limitations by incorporating structured, analytical thinking. DeepSeek-R1 is one such breakthrough. Comparable in performance to some of the most advanced models from competitors like OpenAI, DeepSeek-R1 demonstrates the higher-level reasoning needed in fields such as research, engineering, and finance.

Do you think it is possible that it was developed and runs with far less computing power than peers?

What’s remarkable is that DeepSeek-R1 was built with a fraction of the investment, using much lower hardware costs and less energy than its U.S. counterparts. DeepSeek’s breakthrough in training and inference efficiency is not a single “magic bullet” but rather the result of a series of innovative design choices and deep engineering optimizations across both software and hardware. DeepSeek’s breakthrough starts by only activating the necessary parts of its system for each task, saving on computing power and energy. It can generate several words at once, which speeds up both its training and response times. By using simpler numerical methods, the system can operate on less expensive hardware. Additionally, optimized data sharing ensures all computers work together smoothly without wasting resources.

What do you think this means for the capital expenditure budgets of the large US tech players?

These innovations mean that companies can achieve high-performance results with less physical hardware, potentially lowering the need for huge investments in data centers and expensive GPUs. In practical terms, U.S. tech giants may be able to reallocate part of their massive capital expenditures away from raw compute infrastructure and towards further research and development. There is also a possibility of a Jevons paradox—where improved efficiency leads to lower costs per task, but overall usage increases significantly. Even if each training or inference operation becomes cheaper, the broader accessibility of these efficient AI models could drive higher overall demand. Consequently, U.S. companies might shift their spending from simply increasing capacity to investing in systems that support high-volume, efficient, and scalable AI applications.

Overall, this is an exciting time for the industry. As breakthroughs like DeepSeek-R1 redefine what is possible in AI. By fully disclosing and open-sourcing all these innovations including the use of reinforcement learning that mimics human-like learning, DeepSeek encourages broader experimentation. This opens the door for more companies to develop sophisticated AI solutions without facing prohibitive upfront expenses, fostering innovation in specialized applications and potentially spurring another major wave of AI adoption in the coming year.

Deep Impacts

What was most fascinating to watch was the way the market reacted to the news from China. As expected, some of the largest semiconductor winners dropped 15-20% on the day. In addition, the narrative over the last 12 months had also shifted to power consumption and power producers being the beneficiaries of the AI race. On the day, several power producers and manufacturers of power generators, also were down 15-25% while nuclear and natural gas related names also dropped much more than the overall market.

Over the next few days many of the names recovered while Nvidia did not. Was the event a small tremor of further market disruption to come or will we continue to see adaptation and the U.S. continue to outperform? To us it always looked like U.S. stock market was priced for perfection versus the rest of the world, which is priced for recession. We expect further dispersion across sectors and geographies, hopefully increasing the opportunity set for fundamentally driven active management.

We are delighted to share a special edition of Sagard Perspectives: Unpacking the DeepSeek Effect as supplementary material.

My very best,

Harv

The AI landscape has undergone a significant shift with DeepSeek’s recent release of its open-source DeepSeek-R1 model.

This release isn’t incremental; it represents a potential paradigm shift. In this special edition of Sagard Perspectives, we demystify the key advancements at play. François Lafortune, Managing Partner at Sagard and Co-Founder & CEO of Diagram and Parinaz Sobhani, Head of AI at Sagard, dive into various dynamics, breaking down how a cheaper, advanced open-source reasoning model has shaken up the AI world.

- Enhanced Cost Efficiency: Training costs are reportedly significantly lower, potentially democratizing access to advanced AI development

- Advanced Reasoning Capabilities: DeepSeek-R1 is demonstrating advanced reasoning capabilities that rival or exceed those of leading existing models

- Open-Source Accessibility: Released under the MIT license, the model fosters collaboration and accelerates innovation within the AI community

Listen to our Special Edition of Sagard Perspectives webinar during which we analyze the implications of DeepSeek-R1 and its potential to reshape the AI landscape.

Password: SPAIFeb2025