Good morning all and I hope as you are reading this you aren’t about to dig out your driveway from the snow! We spent many hours last weekend as a family doing just that.

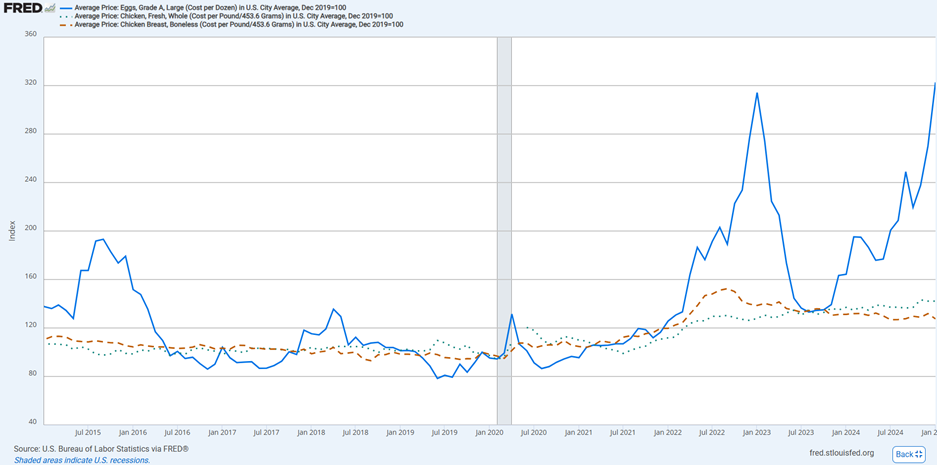

The release of the U.S. Consumer Price Level last week, surprised the market with a 0.5% month over month increase versus expectations of 0.3%. Amongst many sources of inflation for the month, the rise in the cost of a dozen eggs was the story the media seemed to focus on. The cost of eggs has risen 53% over the past 12 months in the U.S., with prices moving above the highs we saw in COVID (see chart below):

So why have prices continued to increase in eggs and why hasn’t inflation subsided more quickly?

There are two main inflation drivers: scarcity and debasement. Over the last 5 years, it seems like both factors have been driving inflation higher. In the case of scarcity, prices are driven higher by cuts in supply, while increases in the money supply (debasement) increase general demand levels. In either case, prices move higher.

Scarcity

Decreases in the supply of goods or services, tend to cause increases in price (as my high school economics teacher would make sure we caveated this type of comment with “ceteris paribus” – assuming all other factors remain constant). If demand levels stay the same and supply decreases, then prices will rise. Through the early stages of COVID we were all faced with this type of inflation. There were supply shortages of everything from groceries to used cars and of course toilet paper. As a society we were not consuming more of this, but their supply had been reduced. In effect these goods had become scarce.

The increase in the price of eggs this year is a good example of this. Following on from salmonella issues last year, there have been outbreaks of bird flu (H5N1 virus) amongst the chicken population of the U.S. Birds that become sick, tend to die relatively quickly therefore not only decreasing the supply of chicken but also eggs.

Scarcity can and has occurred across many different markets:

- Cocoa shortages due to a drought in the Ivory Coast

- Natural gas supplies in Europe following the shutdown of the pipeline from Russia

- Coffee shortages due to droughts in Brazil and flooding in Vietnam

Scarcity driven price increases tend to be rapid with the passthrough effects taking some time to trickle down to everyone’s wallets. The difference over the last 5 years is that we have all become accustomed to price increases and they are passed through more quickly.

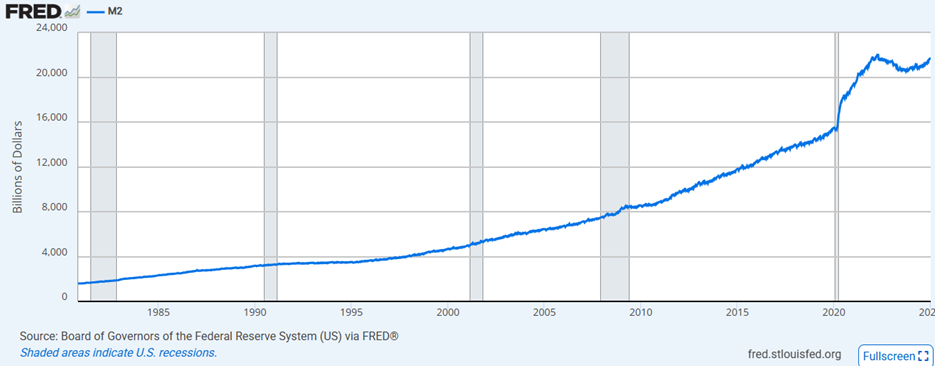

Debasement

Debasement is a more secular source of inflation, driven by the devaluation of currencies through increases in the supply of money. As we have written before in these pieces, this type of inflation has also been impactful over the last few years. Fiscal and monetary programs since the outbreak of COVID have dramatically increased the supply of money. The chart below is from the Federal Reserve, shows one measure of the money supply in the U.S. (M2). The chart shows that in 2020, there was a sharp incline in the rate of increase in the money supply.

When there is an increase in the supply of money in an economy, it tends to end up in consumers wallets with some saved (see the increase in the stock market) while some is spent (increasing the demand for goods and services). It has led to asset price inflation alongside goods and services inflation.

Inflation Protection

When building a portfolio to protect from inflation, we tend to think of two blocks of assets which have historically outperformed in inflationary environments.

- Real assets (scarcity inflation protection) – these are hard assets where demand patterns don’t change with price increases. Think of Manhattan apartments, airports, energy and other commodities. A basket of real or hard assets has tended to perform well in a scarcity led inflation periods

- Stores of value (debasement inflation protection) – these are assets with limited supply that tend to be alternatives to currencies as a store of value. The key factor here is that their supply is slower than the supply increases of money. The classic example is gold, while today, bitcoin may hold a similar purpose

As we have pointed out in prior pieces, the policies President Trump is pursuing tend to be inflationary. Inflation expectations remain above long-term trends but may not be capturing the upside surprise potential.