Happy Sunday all. It was quite the week on the political and markets front and it’s nice to grab a breather over the weekend. Rather than delving into the noise, I wanted to touch on an important economic concept and how it may influence investment decisions today. The concept is around purchasing power parity (PPP).

The concept is simple, in that foreign exchange rates should be formed at levels that create parity around purchasing power. For example, if a consumer exchanges $100 USD into Great British Pounds (GBP) then they should be able to buy the same amount of goods in London as they can with the $100 in New York. If this condition does not hold, then there will be net exports from the country where the goods are cheaper and vice versa.

Burgernomics

It’s very hard to equate one good or service around the world to see where the purchasing power parity holds. There are very few truly homogeneous goods and services. The Economist, which I am an avid reader of, started a measure of PPP in 1986 and they chose to use the Big Mac as their good. The idea was that a Big Mac is a homogeneous good that is created the same way in every country where it is produced. It does not allow for any local varieties and its consistency tends to be its very selling point for people travelling around the world. A Big Mac is the same, no matter where you buy it.

To quote the Economist:

The Big Mac index was invented by The Economist in 1986 as a lighthearted guide to whether currencies are at their “correct” level. It is based on the theory of purchasing-power parity (PPP), the notion that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services (in this case, a burger) in any two countries. Burgernomics was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible. Yet the Big Mac index has become a global standard, included in several economic textbooks and the subject of dozens of academic studies.

An argument against the Big Mac Index would be that countries with higher GDP per capita can afford to spend more on items such as Big Macs. To adjust for this, the Economist added a GDP adjustment factor over the last few years. One of the relative costs that goes into the production of a Big Mac is labour costs. So far, McDonalds may have automated the teller experience, but the production of the Big Mac still involves humans. It also involves beef, onions, pickles, cheese (somewhat questionable), lettuce, bread and whatever is in the secret sauce. These all have different local cost structures. Therefore, the costs of production differs by country and region and should be reflected in the relative prices. Another argument against using the index for measuring PPP is that Big Macs are not transferable or transportable. They are perishable goods and therefore you can’t export or import them to equalize on value. Let’s ignore that for now and have some fun with the concept.

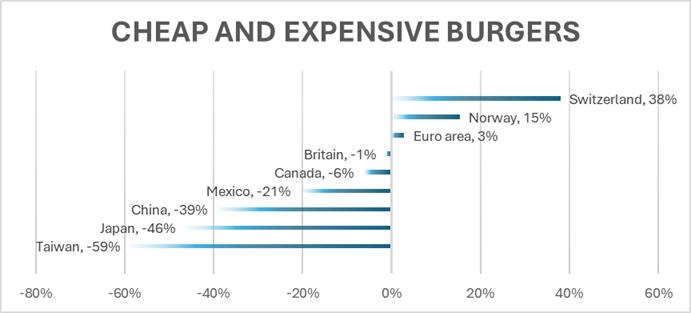

So where do we stand today on the relative prices of Big Macs and the exchange rates? The chart below with data from the Economist, highlights a few countries from their study, with the relative costs of Big Macs versus exchange rates (using the U.S. Dollar cost as the relative measure). Countries that show up with a positive number, show that based upon these measures, currencies are expensive. Negative numbers show currencies that are cheap relative to U.S. Dollars.

I highlighted only a few of the countries from the list in the chart above. So, for you burger lovers, the cheapest Big Mac in the world right now can be found in Taipei, while the most expensive is in Zurich. Here in Canada, the poor performance of the Loonie means that we are eating Big Macs 6% cheaper than our friends to the south. The table also points to opportunities from an investing point of view. Even with an increase of 6% YTD, we still think that the Japanese Yen is incredibly cheap.

President Trump is partial to a Big Mac. Maybe someone in his cabinet has been reading the Economist, driving the recent approach to decrease in the valuation in the U.S. Dollar.

“Smiles are Free”

Photo: margomartin/X

For all us Canadians, we can buy a far superior Canadian hamburger. Go with the Big Harv.