Good morning all and once again it’s nice to embrace the relative calm of the weekend. On Thursday, arguably the best ‘win or go home’ tournament in sports started with both the women’s and men’s NCAA basketball tournament, fondly referred to as March Madness. March Madness could just as easily be the best tagline for some of the financial market action we are seeing this month. Just as some brackets may already be broken, so are some portfolios.

The NCAA basketball tournaments are one of a kind. They pit the best 64 U.S. colleges against each other in a knockout format. It’s simple. Win and you get to move to the next round. Win six straight games and you are the champion. Lose and your season is over. I’m fascinated by predictions and odds with March Madness offering an abundance of data. The odds to submit a perfect bracket are calculated as 1 in 9.2 quintillion (that’s a 19-digit number). Elon Musk is offering a trip to Mars to anyone that can do this, and Warren Buffet famously offered a $1billion prize in 2014 for a perfect bracket. To quote Lloyd from Dumb and Dumber; “So you’re telling me there is a chance” or Han Solo; “Never tell me the odds”.

U.S. college basketball coaches have historically been higher paid than their NBA counterparts. Firstly, college basketball revenues have only been split (or at least historically have been) amongst the colleges and the coaches. Secondly, the job of managing college basketball is so much tougher as you have negative survivorship bias working against you.

Survivorship Bias

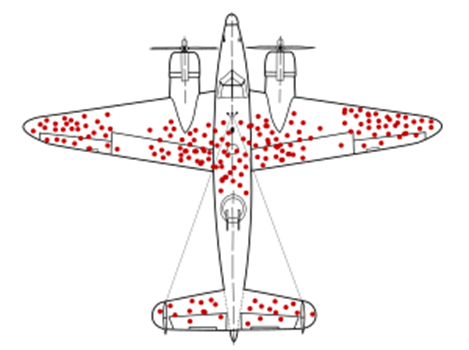

Survivorship bias is defined as the logical error of concentrating on entities that passed a selection process while overlooking those that did not. A great example occurred in World War II, where the statistician Abraham Wald mapped the bullet damage of returning aircraft (see diagram below). His simple approach was to reinforce the areas where the damage had not occurred (those areas without the red dots) as hits in those places probably downed aircraft while the red areas showed places the aircraft could survive hits. The idea was simple, study the survivors.

Source: Wikipedia

Negative Survivorship Bias

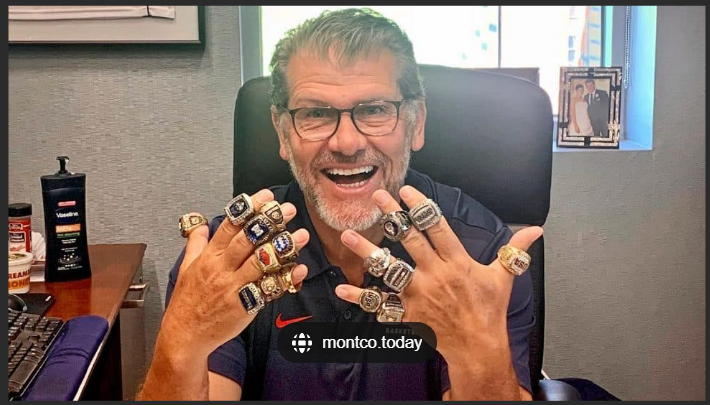

At best as a college coach, you can hope to keep your team together for four years. If you do a great job building a great team and coaching them to success, you end up losing your best talent. As the team and players are successful, scouts and agents will take notice, convincing your players to join the draft, showing their intentions to turn pro. Winning today almost hurts your chances of winning tomorrow. It’s the opposite of momentum investing, where you keep winning trades on and cut your losers. For this very reason it is very hard to win back-to-back titles or build dynasties in college sports. That leaves the coaches as a key difference and their ability to constantly rebuild teams extremely valuable. That’s why the very best college basketball coaches are paid the most. There are very few Coach K’s (5 men’s NCAA tournament championships within 24 years at Duke) or Geno Auriemma (an amazing 11 NCAA tournament championships with the UConn women’s team) that can rebuild winning teams. I certainly appreciate what many of these legendary coaches have achieved.

Geno Auriemma: More Rings Than Fingers

Within investing, survivorship bias is very prominent. It occurs in many different forms and a few of those are outlined below:

Indices

Most equity indices are built around rules on market capitalization and liquidity. When stocks hit certain thresholds on both, they can be included or excluded from index participation. The stocks that are added to an index such as the S&P 500 tend to see immediate buying from index managed funds, while those dropping out of the index are sold. Therefore, the large cap indices themselves are standing testament to the winners.

Peer Analysis

For investment managers, comparisons across peers are very important, especially for the quantitative analysis from potential clients. One problem they face when comparing their track records versus their peers is that due to survivorship bias, the weaker competition is likely to close their funds while the stronger returns remain in the sample. The longer your track record, the more likely you are only facing the best from the industry.

Market Cap

Many equity investment firms specialize in a certain region of market capitalization (venture capital, small-cap as examples). Small-cap managers live with negative survivorship bias all the time. As small-cap companies are successful, their stock prices can well rise, increasing their market capitalization, forcing them out of the investable universe for the manager.

Our job is to sift through these biases and make sure these do not overly influence our decision making. Unlike my March Madness bracket choices, which was much more of a random walk like approach!